Want to profit in both bull and bear crypto markets? The answer lies in mastering long/short positions. The essential tools every serious futures trader uses daily. This isn’t theory; it’s your practical blueprint for making money whether prices soar or crash.

What Crypto Futures Really Mean for Your Portfolio

With cryptocurrency futures trading, you may make predictions about future price changes without actually holding the asset. Imagine being able to forecast where Bitcoin will be next week and earning money if you are correct, regardless of whether you wager on rising or falling prices. This is where long/short positions transform from concepts into profit engines.

Because they simply know how to purchase and hope, the majority of traders fail. Successful traders understand how to make money in any kind of market. Prior to using leverage or sophisticated tactics, you need to comprehend this fundamental fact: Long refers to wagering on price increases. Short equals to betting on price decreases. Master this, and you unlock the entire crypto futures market.

Also Read: A Comprehensive Guide on Futures Trading

Going Long: The Art of Profiting from Rising Markets

You are making a well-thought-out bullish wager when you “go long” in cryptocurrency futures. You’re putting yourself in a position to profit from upward momentum rather than merely hoping that prices will climb

The trader’s mindset for long positions:

- You’ve recognized unmistakable bullish indicators, such as big volume surges, good financing rates, and breaching resistance levels.

- Fear has given way to greed in the market.

- Technical indicators point to future higher trends.

- You have specific profit targets and defined risk parameters

How the money actually flows:

- Entry at $30,000 → Price rises to $35,000 → You profit $5,000 per contract

- Entry at $30,000 → Price falls to $28,000 → You lose $2,000 per contract

The trap most fall into:

They go long because “it feels right” or “everyone’s bullish.” Professional traders go long because specific conditions align with their strategy. Emotional longing leads to losses. Strategic longing leads to consistent gains.

Going Short: Turning Market Crashes into Profit Opportunities

Short selling represents the ultimate power move in trading—profiting from others’ losses. When markets tumble, most investors panic. Short sellers profit.

When experienced traders initiate shorts:

- Clear breakdown of support levels with increasing volume

- Funding rates turn heavily negative

- Market structure shows lower highs and lower lows

- Fear dominates market sentiment

- You’ve identified specific downside targets

The profit mechanism simplified:

- Sell at $50,000 first → Buy back at $45,000 later → Pocket $5,000 difference

- Sell at $50,000 first → Price rises to $52,000 → Buy back higher for $2,000 loss

Current market scenario:

Ethereum fails three times at $3,800 resistance. Volume dries up on upward moves. It breaks below $3,700 support with increasing volume. You initiate a short at $3,680. ETH price drops to $3,550 over two days. You cover at $3,560, securing $120 profit per contract.

Critical insight:

Shorting requires psychological fortitude. You’re betting against popular sentiment. You need conviction in your analysis and strict risk management. The most successful short sellers are often the most disciplined traders in the market.

Side-by-Side Battle: Long vs Short in Real Trading

| Aspect | Long Position Reality | Short Position Reality |

|---|---|---|

| Market Condition | Uptrend confirmed, bullish momentum | Downtrend established, bearish pressure |

| Entry Psychology | Buying strength on breakouts | Selling weakness on breakdowns |

| Risk Profile | Limited to 100% (price to zero) | Theoretically unlimited (price can rise infinitely) |

| Common Catalyst | Positive news, institutional buying, halving events | Regulatory fears, exchange issues, macroeconomic pressure |

| Exit Strategy | Take profit at resistance, stop loss below support | Take profit at support, stop loss above resistance |

| Emotional Challenge | FOMO on the way up, greed at peaks | Fear during rallies, premature covering in panic |

The professional difference:

Amateurs pick sides based on gut feelings. Professionals let market structure dictate their position. They don’t favor long or short—they favor whatever the market is telling them.

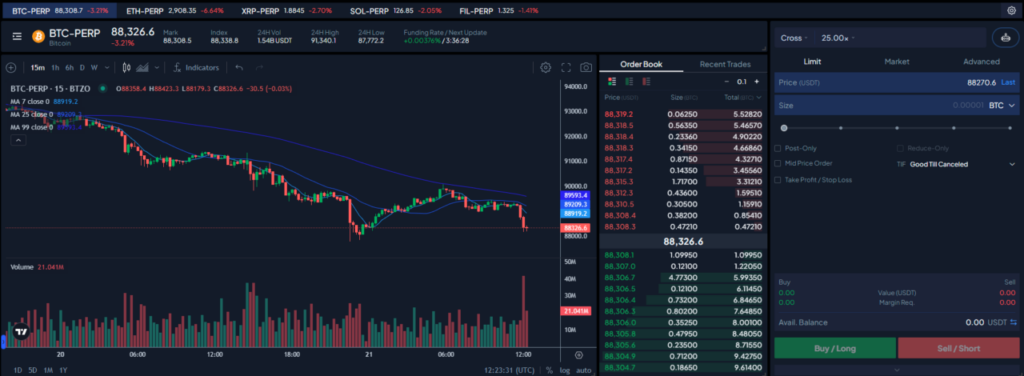

Your Step-by-Step Execution Guide on BTZO

Opening a Long Position (BTCUSDT Example):

- Step 1: Navigate to BTCUSDT perpetual futures on BTZO

- Step 2: Set order type: Limit for precision, Market for speed

- Step 3: Input entry price (e.g., $63,250 for limit orders)

- Step 4: Select position size (start with 0.01 BTC equivalent if testing)

- Step 5: Critical step: Set stop-loss immediately (e.g., $62,800)

- Step 6: Set take-profit target (e.g., $65,000)

- Step 7: Confirm BUY/LONG order

- Step 8: Monitor position in “Open Orders” until filled

Opening a Short Position (ETHUSDT Example):

- Step 1: Select ETHUSDT perpetual market

- Step 2: Toggle from BUY to SELL

- Step 3: Choose entry method (Market at $3,420 or Limit at $3,415)

- Step 4: Determine contract quantity based on risk tolerance

- Step 5: Non-negotiable: Place stop-loss above recent high (e.g., $3,460)

- Step 6: Set profit target at next support (e.g., $3,350)

- Step 7: Execute SELL/SHORT order

- Step 8: Watch order book for fill confirmation

Position Management Protocol:

- Never enter without predetermined exit points

- Adjust stop-loss to breakeven after price moves favorably

- Take partial profits at key levels

- Never add to losing positions

- Close position if original thesis invalidates

Three Trading Strategies That Actually Generate Returns

Trend Confirmation Strategy

This isn’t about predicting trends—it’s about confirming and riding them.

- For longs: Wait for price to establish higher highs AND higher lows on the 4-hour chart. Enter on pullback to moving average support. Exit when momentum indicators diverge negatively.

- For shorts: Confirm lower highs AND lower lows across multiple timeframes. Enter on retracement to dynamic resistance. Exit when selling volume decreases substantially.

- Why this works: It removes emotion. You’re not guessing direction—you’re trading confirmed market movements with statistical edges.

Liquidity Zone Strategy

Markets move toward areas of resting liquidity (stop-loss concentrations).

- Long setup: Identify where most shorts have stop-losses above current price. Market often “runs” these stops before reversing down. Enter long after the stop-run when price reclaims key level.

- Short setup: Locate where longs have clustered stop-losses below support. Market typically sweeps these lows before bouncing. Enter short after the sweep when price fails to recover.

- Professional edge: This strategy exploits how markets actually function—hunting liquidity before making sustained moves.

Timeframe Alignment Strategy

Eliminate noise by trading only when multiple timeframes agree.

Long entry conditions:

- Weekly trend: Bullish

- Daily trend: Bullish

- 4-hour: Pullback to support

- 1-hour: Bullish reversal pattern forming

Short entry conditions:

- Weekly: Bearish or ranging

- Daily: Bearish structure

- 4-hour: Rally to resistance

- 1-hour: Bearish rejection pattern

- The power: This filter eliminates 80% of false signals. You only trade when the market’s story is consistent across time perspectives.

The Professional Trader’s Mindset Shift

Mastering long/short positions requires rewiring how you view markets. It’s not about being bullish or bearish. It’s about being right. And sometimes being right means shorting during a supposed “bull market” or longing during widespread panic.

The reality check most need:

If you’re always longing, you’re missing 50% of profit opportunities. Markets trend down as often as they trend up. The complete trader profits in both directions.

Risk management isn’t optional:

Every position needs a stop-loss. Every trade needs a risk-reward ratio of at least 1:2. Every session needs a maximum loss limit. Without these, you’re gambling, not trading.

Final Thoughts:

Long/short positions are your vehicles, but market analysis is your navigation system. Without proper analysis, even the best vehicle crashes. With sharp analysis, these positions become predictable profit generators.

The markets don’t care about your opinion. They only respond to price action. Your job isn’t to predict. It’s to react correctly to what’s happening. Long when structure says long. Short when structure says short. This disciplined approach separates consistent earners from perpetual losers.